By Ava Owen April 22, 2025

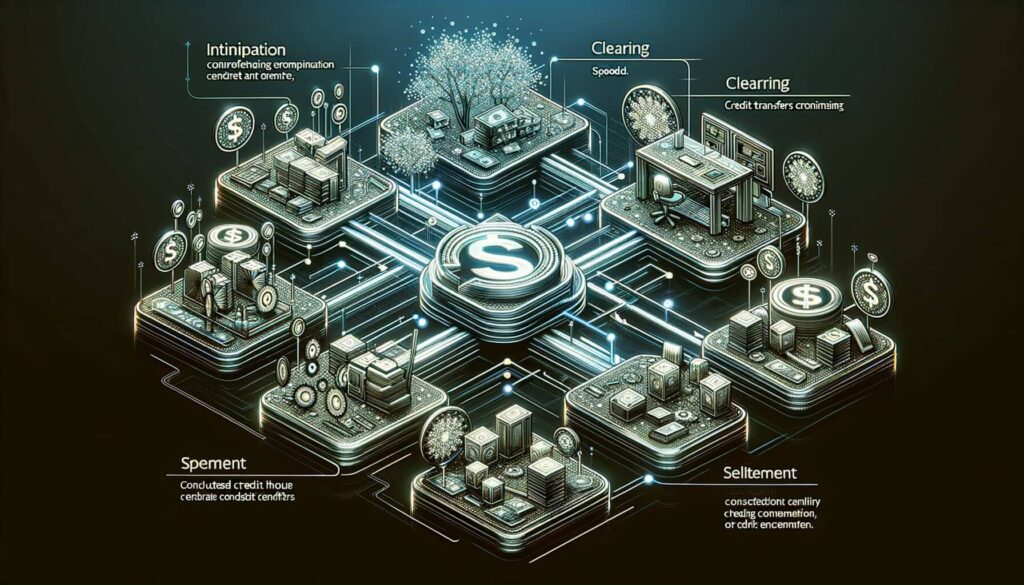

In today’s digital age, electronic payments have become increasingly popular and convenient. One such method is the Automated Clearing House (ACH) transfer, which allows individuals and businesses to send and receive funds electronically.

ACH transfers are widely used for various purposes, including payroll deposits, bill payments, and business-to-business transactions. This article will provide a comprehensive overview of ACH transfers, focusing on the two main types: ACH credit transfers and ACH debit transfers.

A Closer Look at ACH Credit Transfers: How They Work and Their Benefits

ACH credit transfers are a type of electronic payment where funds are initiated by the sender and deposited into the recipient’s account. This method is commonly used for direct deposits, such as payroll, tax refunds, and government benefits. To initiate an ACH credit transfer, the sender provides their bank with the recipient’s account and routing numbers, along with the desired amount to be transferred. The sender’s bank then sends the funds to the recipient’s bank, which credits the funds to the recipient’s account.

One of the key benefits of ACH credit transfers is their efficiency and cost-effectiveness. Unlike traditional paper checks, ACH credit transfers eliminate the need for physical transportation and manual processing, resulting in faster and more streamlined transactions. Additionally, ACH credit transfers are often more affordable than other payment methods, such as wire transfers or credit card payments, making them an attractive option for businesses and individuals alike.

Exploring ACH Debit Transfers: Understanding the Process and Advantages

ACH debit transfers, on the other hand, involve the recipient initiating the payment and authorizing the sender to withdraw funds from their account. This method is commonly used for recurring payments, such as utility bills, mortgage payments, and subscription services. To initiate an ACH debit transfer, the recipient obtains the sender’s account and routing numbers and obtains their authorization to withdraw funds. The recipient’s bank then debits the funds from the sender’s account and transfers them to the recipient’s account.

ACH debit transfers offer several advantages, including convenience and flexibility. Recurring payments can be set up to occur automatically, eliminating the need for manual intervention each time a payment is due. This not only saves time but also reduces the risk of late or missed payments. Additionally, ACH debit transfers provide greater control over cash flow, as the recipient can accurately predict when funds will be received and plan accordingly.

Key Differences Between ACH Credit and Debit Transfers

While both ACH credit and debit transfers are electronic payment methods, there are several key differences between the two. The most significant difference lies in the direction of the transaction. In ACH credit transfers, the sender initiates the payment and deposits funds into the recipient’s account. In contrast, ACH debit transfers involve the recipient initiating the payment and authorizing the sender to withdraw funds from their account.

Another difference is the level of control and authorization required. In ACH credit transfers, the sender has full control over the transaction and can initiate it without the recipient’s involvement. On the other hand, ACH debit transfers require the recipient’s authorization for each payment, ensuring that funds are only withdrawn with their consent.

Factors to Consider When Choosing Between ACH Credit and Debit Transfers

When deciding between ACH credit and debit transfers, several factors should be taken into consideration. One important factor is the nature of the transaction. If the sender needs to make a one-time payment or deposit funds into another account, ACH credit transfers may be the preferred option. On the other hand, if the recipient needs to collect recurring payments or authorize withdrawals from another account, ACH debit transfers would be more suitable.

Another factor to consider is the level of control and convenience desired. ACH credit transfers provide the sender with full control over the transaction, allowing them to initiate payments at their convenience. In contrast, ACH debit transfers require the recipient’s authorization for each payment, which may be more suitable for situations where regular payments need to be collected.

A Comprehensive Comparison of ACH Credit and Debit Transfer Fees

When it comes to fees, ACH credit and debit transfers differ in their cost structure. ACH credit transfers typically have lower fees compared to ACH debit transfers. This is because ACH credit transfers are initiated by the sender, who bears the cost of the transaction. In contrast, ACH debit transfers involve the recipient initiating the payment, and the sender’s bank may charge a fee for processing the transaction.

It is important to note that the specific fees associated with ACH transfers can vary depending on the financial institutions involved. Some banks may charge flat fees for each ACH transfer, while others may have a tiered fee structure based on the transaction amount. It is advisable to check with your bank or payment processor to understand the fees associated with ACH transfers and choose the option that best suits your needs.

Security Measures and Fraud Prevention in ACH Credit and Debit Transfers

Security is a crucial aspect of any electronic payment system, and ACH transfers are no exception. To ensure the safety of ACH credit and debit transfers, various security measures and fraud prevention mechanisms are in place.

One such measure is the use of secure networks and encryption protocols to protect the transmission of sensitive information. ACH transfers are typically conducted over secure channels, such as Virtual Private Networks (VPNs) or Secure Socket Layer (SSL) connections, which encrypt the data and prevent unauthorized access.

Additionally, financial institutions and payment processors implement robust authentication and verification procedures to ensure that only authorized individuals can initiate or authorize ACH transfers. This may include the use of multi-factor authentication, such as passwords, security tokens, or biometric verification.

Furthermore, monitoring and detection systems are employed to identify and prevent fraudulent activities. Banks and payment processors analyze transaction patterns and employ advanced algorithms to detect suspicious behavior, such as unusual transaction amounts or frequency. If any suspicious activity is detected, additional verification steps may be required before the transaction is processed.

ACH Credit vs Debit: Impact on Businesses and Consumers

Both ACH credit and debit transfers have a significant impact on businesses and consumers. For businesses, ACH transfers offer numerous benefits, including cost savings, improved cash flow management, and increased efficiency. By utilizing ACH credit transfers for payroll, businesses can streamline their payment processes, reduce administrative costs, and ensure timely and accurate payments to employees. Similarly, ACH debit transfers enable businesses to collect recurring payments more efficiently, reducing the risk of late or missed payments and improving cash flow predictability.

For consumers, ACH transfers provide convenience, security, and flexibility. With ACH credit transfers, consumers can receive direct deposits, such as their salaries or government benefits, directly into their bank accounts, eliminating the need for physical checks or cash. ACH debit transfers allow consumers to automate recurring payments, ensuring that bills are paid on time and reducing the risk of late fees or service interruptions.

Frequently Asked Questions (FAQs) about ACH Credit and Debit Transfers

Q1: What is the difference between ACH credit and ACH debit transfers?

A1: The main difference is the direction of the transaction. ACH credit transfers involve the sender initiating the payment and depositing funds into the recipient’s account, while ACH debit transfers involve the recipient initiating the payment and authorizing the sender to withdraw funds from their account.

Q2: Are ACH transfers secure?

A2: Yes, ACH transfers are secure. Financial institutions and payment processors employ various security measures, such as encryption protocols and authentication procedures, to protect the transmission of sensitive information and prevent unauthorized access.

Q3: How long does it take for an ACH transfer to be processed?

A3: The processing time for ACH transfers can vary depending on several factors, including the financial institutions involved and the time of submission. Generally, ACH transfers are processed within one to three business days.

Q4: Can I reverse an ACH transfer?

A4: It is possible to reverse an ACH transfer, but the process can be complex and may require the involvement of both the sender and recipient’s banks. It is advisable to contact your bank or payment processor for guidance on reversing an ACH transfer.

Q5: Are there any limits on the amount that can be transferred through ACH?

A5: There are no specific limits on the amount that can be transferred through ACH. However, individual banks may impose their own limits based on their policies and the customer’s account type.

Conclusion

In conclusion, ACH transfers are a convenient and efficient method of electronic payment, offering benefits for both businesses and consumers. ACH credit transfers allow senders to deposit funds into recipients’ accounts, while ACH debit transfers enable recipients to authorize withdrawals from senders’ accounts. The choice between ACH credit and debit transfers depends on factors such as the nature of the transaction, desired level of control, and cost considerations.

With robust security measures and fraud prevention mechanisms in place, ACH transfers provide a secure and reliable means of conducting financial transactions. By understanding the differences and advantages of ACH credit and debit transfers, individuals and businesses can make informed decisions and leverage the benefits of this electronic payment method.