By Ava Owen April 22, 2025

ACH (Automated Clearing House) payments have become an integral part of the modern financial landscape. These electronic transactions allow individuals and businesses to transfer funds securely and efficiently.

However, one common question that arises is, “How long do ACH payments take to process?” In this comprehensive guide, we will delve into the intricacies of ACH payment processing, exploring the factors that affect processing time, settlement times, expedited options, cut-off times, common delays, and how to track and monitor ACH payments.

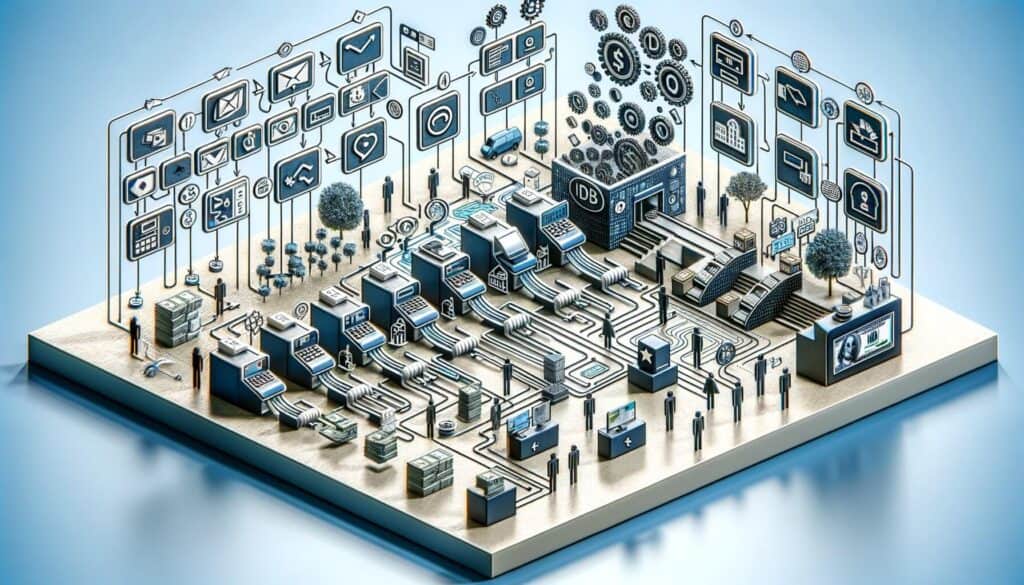

The ACH Payment Process: Step-by-Step Guide

To understand the time it takes for an ACH payment to process, it is essential to grasp the underlying steps involved. The ACH payment process typically consists of the following stages:

1. Initiation: The payment originator, whether an individual or a business, initiates the ACH payment by providing the necessary information, including the recipient’s bank account details and the amount to be transferred.

2. Originating Depository Financial Institution (ODFI): The ODFI is the financial institution that receives the payment initiation request from the originator. They verify the information provided and ensure compliance with ACH rules and regulations.

3. ACH Operator: The ACH operator acts as an intermediary between the ODFI and the receiving financial institution. They facilitate the secure transmission of payment instructions and ensure the smooth flow of funds.

4. Receiving Depository Financial Institution (RDFI): The RDFI is the recipient’s financial institution. They receive the payment instructions from the ACH operator and credit the funds to the recipient’s account.

5. Settlement: The final stage involves the settlement of funds between the ODFI and the RDFI. This process ensures that the funds are transferred from the originator’s account to the recipient’s account.

Factors Affecting ACH Payment Processing Time

Several factors influence the processing time of ACH payments. Understanding these factors can help manage expectations and plan transactions accordingly. The key factors affecting ACH payment processing time include:

1. ACH Network Processing Schedule: The ACH network operates on specific processing schedules, typically with multiple processing windows throughout the day. The timing of the payment initiation within these windows affects the processing time.

2. Weekends and Holidays: ACH payments do not process on weekends or federal holidays. If a payment is initiated on a non-processing day, it will be delayed until the next available processing window.

3. Payment Volume: The volume of ACH payments being processed at any given time can impact processing time. Higher payment volumes may result in longer processing times due to increased demand on the ACH network.

4. Compliance and Verification: Financial institutions must comply with various regulations and perform necessary verifications to ensure the legitimacy of ACH payments. These compliance checks can introduce additional processing time.

5. Error Resolution: If any errors or discrepancies are identified during the payment process, additional time may be required to resolve the issue. This can include verifying account details, investigating potential fraud, or resolving technical glitches.

A Step-by-Step Guide to Initiating an ACH Payment

Initiating an ACH payment is a straightforward process, provided you have the necessary information and access to the required tools. Here is a step-by-step guide to help you initiate an ACH payment:

1. Gather the Required Information: Before initiating an ACH payment, gather the necessary information, including the recipient’s bank account number, routing number, and any additional details required by your financial institution.

2. Choose the Payment Method: Determine the most suitable method for initiating the ACH payment. This can be done through online banking, a payment processor, or specialized software designed for ACH payments.

3. Enter the Payment Details: Enter the recipient’s bank account number, routing number, and any additional information required by your financial institution. Ensure the accuracy of the information to avoid delays or potential errors.

4. Verify the Payment: Review the payment details to ensure accuracy and completeness. Double-check the recipient’s account information and the amount to be transferred.

5. Submit the Payment: Once you have verified the payment details, submit the payment through your chosen method. Follow any additional prompts or instructions provided by your financial institution or payment processor.

6. Keep Track of the Payment: After submitting the payment, keep track of its progress. Some financial institutions provide tracking or confirmation numbers that can be used to monitor the status of the payment.

7. Confirm Successful Transfer: Once the payment has been successfully processed, confirm with the recipient that the funds have been received in their account. This step ensures transparency and helps resolve any potential issues promptly.

How Long Does it Take for ACH Payments to Clear?

The time it takes for ACH payments to clear can vary depending on several factors, including the processing schedule, weekends, holidays, and the verification process. On average, ACH payments typically take between 1 to 3 business days to clear.

Payments submitted before the cut-off time on a business day are usually processed on the same day, while those submitted after the cut-off time may be processed on the next business day. Weekends and federal holidays are not considered business days, so payments initiated on these days will be processed on the next business day.

It is important to note that while ACH payments generally take 1 to 3 business days to clear, some financial institutions may offer faster processing times. It is advisable to check with your financial institution or payment processor for their specific processing timelines.

Expedited ACH Payments: Is it Possible?

While ACH payments are known for their cost-effectiveness and efficiency, they are not typically designed for immediate or real-time transfers. However, some financial institutions and payment processors offer expedited ACH payment options for an additional fee.

Expedited ACH payments can reduce the processing time significantly, allowing funds to be transferred within the same business day or even within a few hours. These expedited options are particularly useful for time-sensitive transactions or urgent payment requirements.

It is important to note that not all financial institutions or payment processors offer expedited ACH payment options. Additionally, the availability and cost of expedited processing may vary depending on the institution or processor. It is advisable to check with your financial institution or payment processor for their specific expedited ACH payment options and associated fees.

Common Challenges and Delays in ACH Payment Processing

While ACH payments are generally reliable and efficient, there can be certain challenges and delays that may affect the processing time. Understanding these common issues can help mitigate potential delays and ensure smoother payment processing.

1. Insufficient Funds: One of the most common reasons for payment delays or rejections is insufficient funds in the originator’s account. It is crucial to ensure that the account has sufficient funds to cover the payment amount and any associated fees.

2. Incorrect Account Information: Providing incorrect or outdated account information can lead to delays or rejections of ACH payments. It is essential to double-check the recipient’s account number and routing number to ensure accuracy.

3. Closed or Inactive Accounts: If the recipient’s account is closed or inactive, the ACH payment will be rejected. It is important to verify the account status before initiating the payment to avoid unnecessary delays.

4. Verification and Security Checks: Financial institutions may conduct various verification and security checks to ensure the validity and security of ACH payments. These checks can add additional processing time, especially if there are any discrepancies or potential fraud indicators.

5. Non-Business Days: ACH payments are not processed on weekends and federal holidays. Payments initiated on these days will be processed on the next business day, leading to potential delays.

Tips for Faster ACH Payment Processing

While the processing time for ACH payments is largely dependent on external factors, there are certain steps you can take to expedite the payment process. Here are some tips for faster ACH payment processing:

1. Provide Accurate and Up-to-Date Information: Ensure that all payment details, including the recipient’s account number and routing number, are accurate and up-to-date. Double-check the information before initiating the payment to avoid potential delays or rejections.

2. Maintain Sufficient Funds: Ensure that your account has sufficient funds to cover the payment amount and any associated fees. This helps avoid delays due to insufficient funds and ensures a smoother payment process.

3. Plan Ahead: Consider the processing schedules, weekends, and holidays when initiating an ACH payment. If time is of the essence, plan accordingly and initiate the payment well in advance to allow for any potential delays.

4. Opt for Expedited Processing: If expedited ACH payment options are available, consider utilizing them for time-sensitive transactions. While these options may incur additional fees, they can significantly reduce the processing time.

5. Communicate with the Recipient: Maintain open communication with the recipient to ensure a smooth payment process. Confirm with them once the payment has been initiated and inquire about the receipt of funds in their account.

A Closer Look at ACH Payment Settlement Times

Settlement times refer to the duration it takes for funds to be transferred from the originator’s account to the recipient’s account. While ACH payments are generally considered to be more efficient than traditional paper checks, settlement times can vary depending on the type of ACH transaction.

1. Standard ACH Payments: Standard ACH payments, also known as ACH credits, typically settle within one to two business days. This allows for the necessary processing and verification steps to be completed before the funds are transferred.

2. Same-Day ACH Payments: In 2016, the National Automated Clearing House Association (NACHA) introduced same-day ACH payments to expedite the transfer of funds. Same-day ACH payments settle within the same business day, providing faster access to funds for time-sensitive transactions.

Frequently Asked Questions about ACH Payment Processing

Q1. How long does it take for an ACH payment to process?

Answer: The processing time for ACH payments can range from one to two business days for standard payments and same-day settlement for expedited ACH payments.

Q2. Can ACH payments be processed on weekends or holidays?

Answer: No, ACH payments do not process on weekends or federal holidays. Payments initiated on non-processing days will be delayed until the next available processing window.

Q3. Can ACH payments be expedited for faster processing?

Answer: Yes, some financial institutions offer expedited ACH options for faster processing. The exact processing time for expedited ACH payments can vary depending on the institution and service level chosen.

Q4. What are the common causes of delays in ACH payment processing?

Answer: Common causes of delays include insufficient funds, incorrect account information, compliance reviews, and technical glitches within the ACH network or financial institution systems.

Conclusion

Understanding the processing time of ACH payments is crucial for individuals and businesses alike. By comprehending the step-by-step process, factors affecting processing time, settlement times, expedited options, cut-off times, common delays, and tracking methods, one can effectively manage their financial transactions.

While ACH payments are generally efficient, it is essential to consider the various factors that can impact processing time and plan accordingly. By staying informed and utilizing the available tools and resources, individuals and businesses can navigate the ACH payment landscape with confidence and ease.